Local Bank. Local Commitment. Local Decisions.

Personal Banking

We offer the same services and products of a big-box bank but better, with fee-free products like free personal checking… and cookies!

Click here to learn more about personal banking plans.

Business Banking

Banking is a necessity for businesses and some banks make it expensive when it shouldn’t be. We don’t charge fees unless we absolutely have to.

Click here to learn more about business banking plans.

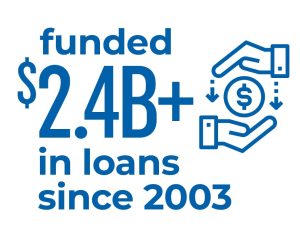

Lending

Local Lending. Local Decisions. We’re not just your lender but your partner. We focus on making the right loan for you. Apply online today.

Click here to learn about residential lending.

Click here to learn about commercial lending.

Community

As Southwest Florida’s largest community bank, we maintain an unwavering commitment to the community we all love.

Click here to explore our community involvement.

Branch Locations

We’re not just an island bank. We have seven, full service Southwest Florida locations to serve your banking needs.